37+ hair stylist tax deduction worksheet

Web Self-employed hairstylists either full- or part-time who earn more than 400 in net income have to file an income tax return. Overall nearly any expense thats directly related to and necessary for your salon or spa can earn you a deduction.

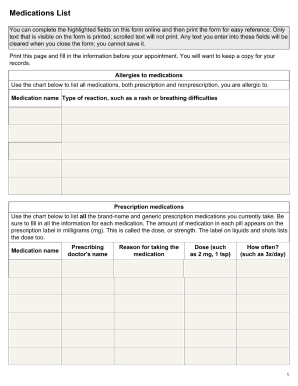

Hair Stylist Tax Deduction Worksheet Fill Out Sign Online Dochub

Small Business Insurance Quotes.

. Free Tax Filing Help. Ad Manage All Your Business Expenses In One Place With QuickBooks. Web Employers in Greenwood Village will take out 2 from your paycheck every month if you earn more than 250 in a calendar month.

Tax-deductible items for hairstylists vary depending on your type of employment. Web Deductions Worksheet line 5 if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Web Standard Deduction Worksheet for DependentsLine 12.

Web Hairstylist Tax Deduction Checklist. Affordable Tax Filing Made Easy. Web Salon Worksheet Name.

With 100 Accuracy Guaranteed. Web Even consider clips caps towels and smaller items. Nail salons dont forget polish acrylics files and UV lamps.

SignNow combines ease of use affordability and security in one online tool all without forcing extra. Automatically Track All Your Income And Expenses. Salon employees will have significantly fewer tax-deductible.

Total Income From Services Total Income From Product Sales Total Tip Income Educator Income. Automatically Track All Your Income And Expenses. Get A Free Guided QuickBooks Setup.

Web expenses may earn you considerable tax breaks. Edit Sign and Save Deductions Checklist Form. Affordable Tax Filing Made Easy.

With 100 Accuracy Guaranteed. Get A Free Guided QuickBooks Setup. Ad TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction.

Ad Web-based PDF Form Filler. They also pay an estimated tax each. Ad TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction.

Tax Table or Tax. Free Tax Filing Help. Ad Manage All Your Business Expenses In One Place With QuickBooks.

Qualified Business Income Deduction Section 199A Deduction Line 16. For Glendale residents the tax rate is 5 a. Web hair stylist expense sheetdesign hair stylist tax deduction worksheet pdf.

Web The Ultimate Hair Stylist Tax Deduction Checklist As a hair stylist you can save hundreds even thousands of dollars at tax time by deducting business. PdfFiller allows users to Edit Sign Fill Share all type of documents online. Web You can either calculate this deduction amount by using a simplified formula of 5 per square foot up to a maximum of 300 square feet or you can keep track of all of.

Web However this is an itemized deduction which means you should only deduct it if all of your itemized deductions combined are worth more than your standard. Spas can deduct skin care products and tools like facial.

Hair Stylist Tax Deduction Worksheet Pdf Fill Online Printable Fillable Blank Pdffiller

Hair Stylist Salon 2019 Tax Deduction Checklist Simply Organics

Tax Tips Free Worksheet For Hair Stylists

Hair Stylist Salon 2019 Tax Deduction Checklist Simply Organics

Hair Stylist Salon 2019 Tax Deduction Checklist Simply Organics

Tax Tips Free Worksheet For Hair Stylists

Kugv3zisle6tsm

Tax Tips Free Worksheet For Hair Stylists

Anchor Tax Service Self Employed General

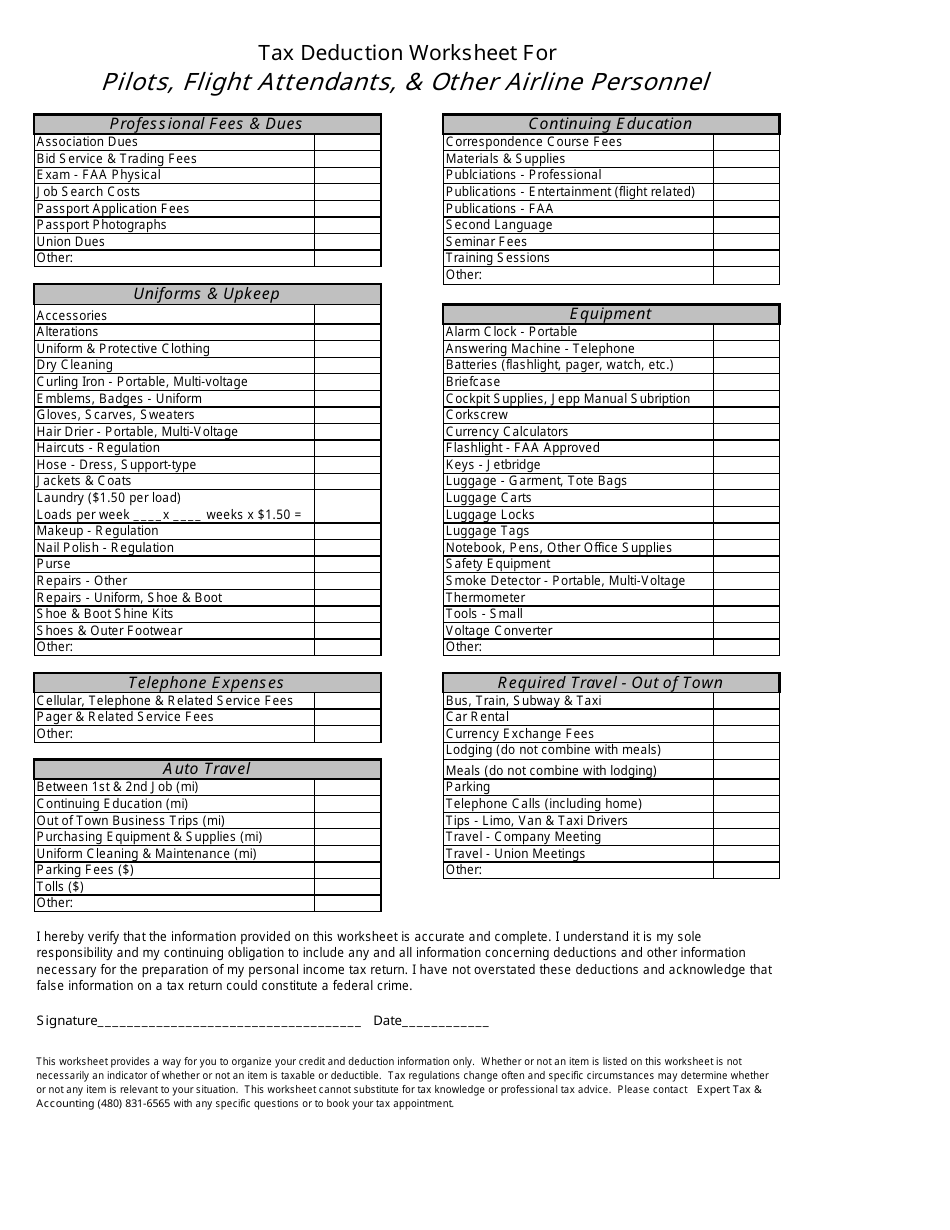

Tax Deduction Worksheet For Pilots Flight Attendants Other Airline Personnel Download Printable Pdf Templateroller

Hairstylist Tax Write Offs Checklist For 2023 Zolmi Com

Pdf A Guide To Zimbabwe Taxation I Edmore Mabeka Academia Edu

A Historical Commentary On Diodorus Siculus Book 15 Pdf Thesis Oxford University Press

What Expenses Are Deductible On Taxes For A Hair Stylist Sapling

List Of Tax Deductions For Hair Stylists Budgeting Money The Nest

Self Employed Tax Deductions Worksheet Form Fill Out And Sign Printable Pdf Template Signnow

Self Employed Hair Stylist Tax Deductions Tips For Filing Youtube